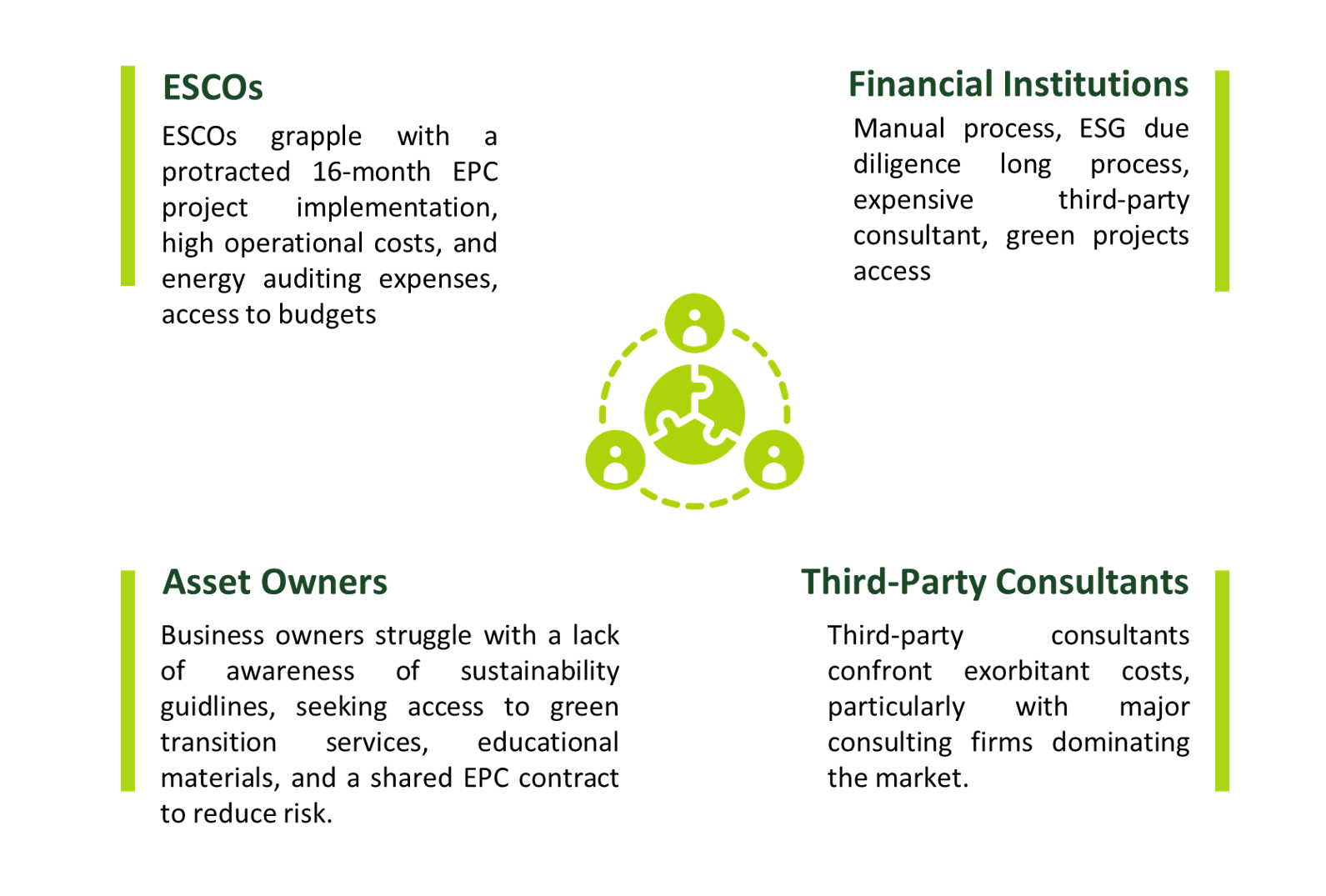

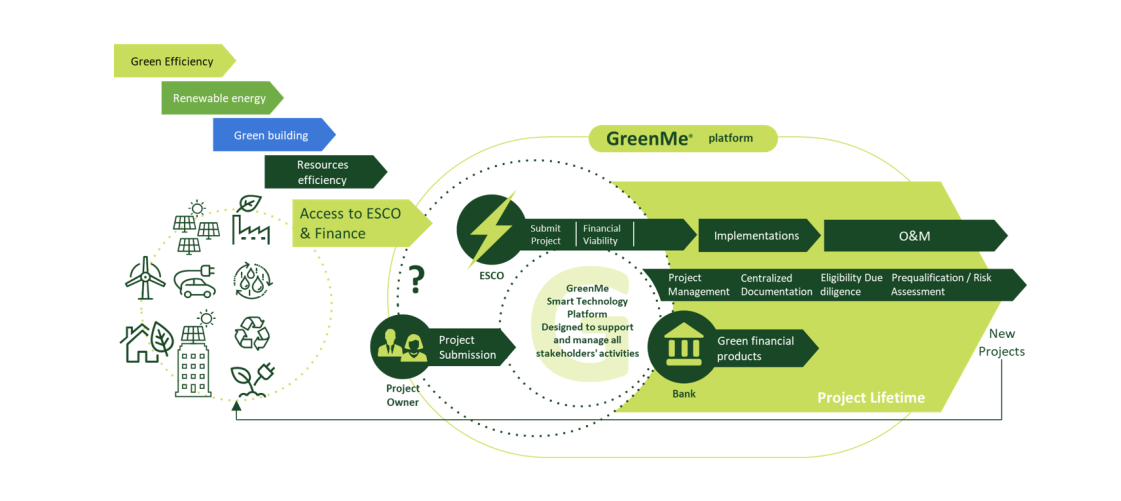

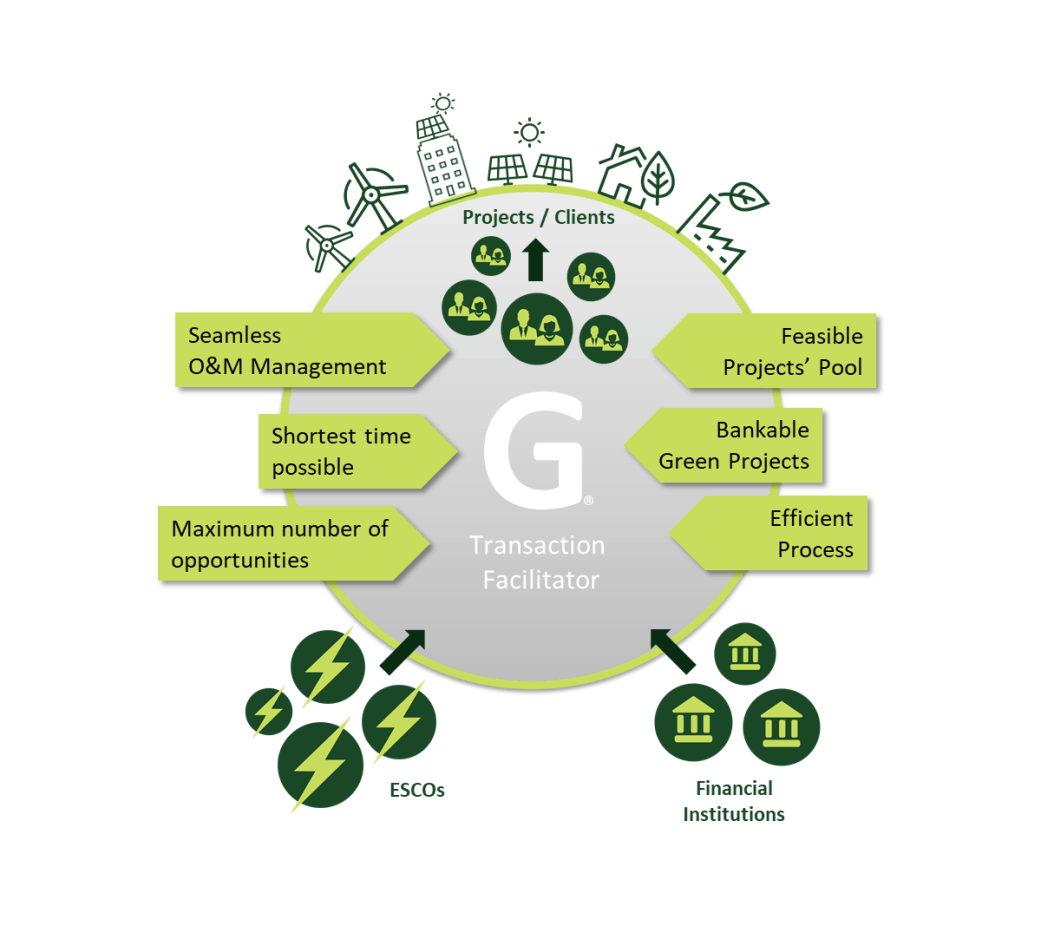

What is GreenMe

Platform

Our platform includes tendering & energy auditing by industry, ESCO & facility services and optimizing the client’s profitability. GreenMe aims to shorten the banking process involved in providing sustainable financing products from over 1.5 months to less than two weeks.